Where did all the people go from the collapsed financial institutions?

As Data Scientists we are regularly asked about interesting trends taking place on LinkedIn. One of the biggest trends in the professional space last year was the economic collapse. Reports from numerous sources all tell a similar story -- the economic downturn has affected thousands of companies with millions of workers laid off.

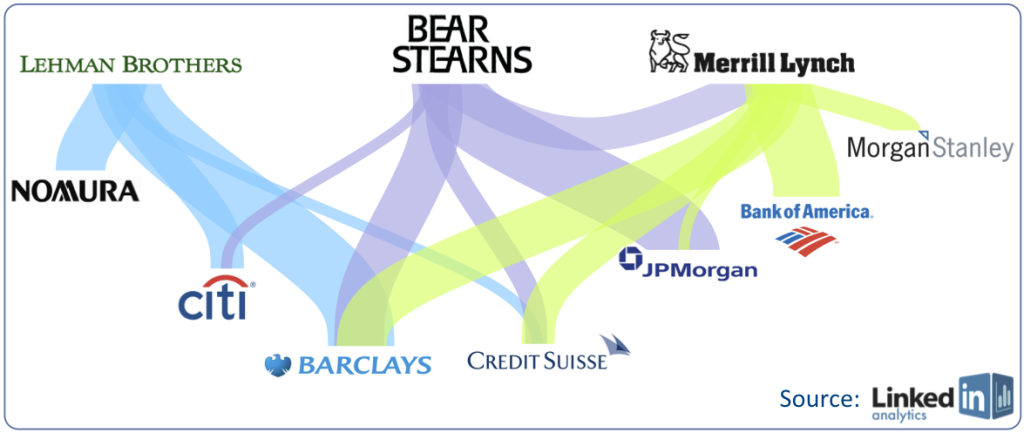

At LinkedIn we have a unique view into the ebbs and flows of labor markets and one trend we noticed was there were beneficiaries of these large-scale upheavals. In particular, we saw substantial spikes in user activity for the following 5 companies during major financial events:

- Barclays

- Credit Suisse

- Citigroup

- Bank Of America

- JP Morgan Chase

Each of these firms saw an increase in the LinkedIn activity of their employees, measured by member registrations or updates to the individual's company title on LinkedIn. This activity coincided with key corporate announcements such as the acquisition of Merrill Lynch by Bank Of America, or the Lehman Brothers bankruptcy announcement.

[caption id="attachment_3889" align="aligncenter" width="503" caption="Talent flow during the financial collapse (Source: LinkedIn Data)"]

Where did all these employees go? One hypothesis is that many of the employees left the financial industry. According to the LinkedIn data set, that just isn't true. There are a handful of people that did transition to other industries and start new careers, but most stayed in the financial space. To be specific, other than two acquiring companies (Bank of America acquired Merrill Lynch and Nomura acquired Lehman Brothers' franchise in the Asia Pacific region), Barclays was by far the biggest beneficiary, scooping up 10% of the laid off talent, followed by Credit Suisse at 1.5% and Citigroup at 1.1 %.

Have you noticed an interesting trend? Do you have a trend or data question you'd like us to answer? Please post them here and we'll feature them in a future blog post.